A recent Trends Report by ITR Economics predicts a slow build for commodity prices, GDP and interest rates.

As more states and countries around the world begin to rollout plans for re-opening, this study predicts a slow build for US GDP, commodity prices, and interest rates. Based on the current data trends, it seems the optimistic recovery predicted for the third quarter of 2020 will take more time to heal the economic wounds of the global pandemic.

WHY A “U” AND NOT A “V”

According to the latest ITR data trends, GDP projections vary from a “U” (best case) to an “L with attitude” (think hockey stick). In the ideal situation, the economic stimulus and the state regulations will make the data trend outlook appear like a “V.” However, that outcome might not be possible. Here’s the reasoning from ITR Economics:

1. Staggered return to the marketplace.

Not all states are allowing their populations to return to the marketplace at the same time. Some states are going to remain sheltering at home longer than others.

2. Different phases of commerce by industry.

The amount of freedom to engage in commerce is being phased in, as opposed to most of us simply returning to our pre-COVID lives.

3. Excess supply of oil.

The other black swan, devastatingly low oil prices, is roaming through the economy and wreaking its own damage, similar to what occurred in 2015-2016. This particular black swan won’t directly benefit from an eventual vaccine until the excess supply of oil is absorbed by the global economy.

4. Labor and resource restrictions.

It is unlikely that we can ramp production back up that quickly in many circumstances because of labor and/or material constraints.

5. Global re-opening circumstances.

It is unlikely that our trading partners will experience a data trend “V.” Remember that approximately 8% of our GDP comes from the export of goods.

6. Fear is the driving factor in consumers, now and potentially in the future.

There are people that are afraid and will act accordingly until there is a vaccine or proven, effective treatment.

7. History suggests a slower bounce back.

While there are precedents for steep declines, there is no precedent for an equally steep climb out.

PRICING PREDICTIONS

Unfortunately, it is clear now that this is more than a temporary disruption in the marketplace. Experts say that the price of oil, aluminum, and other commodities will start to recover when inventories start to go down.

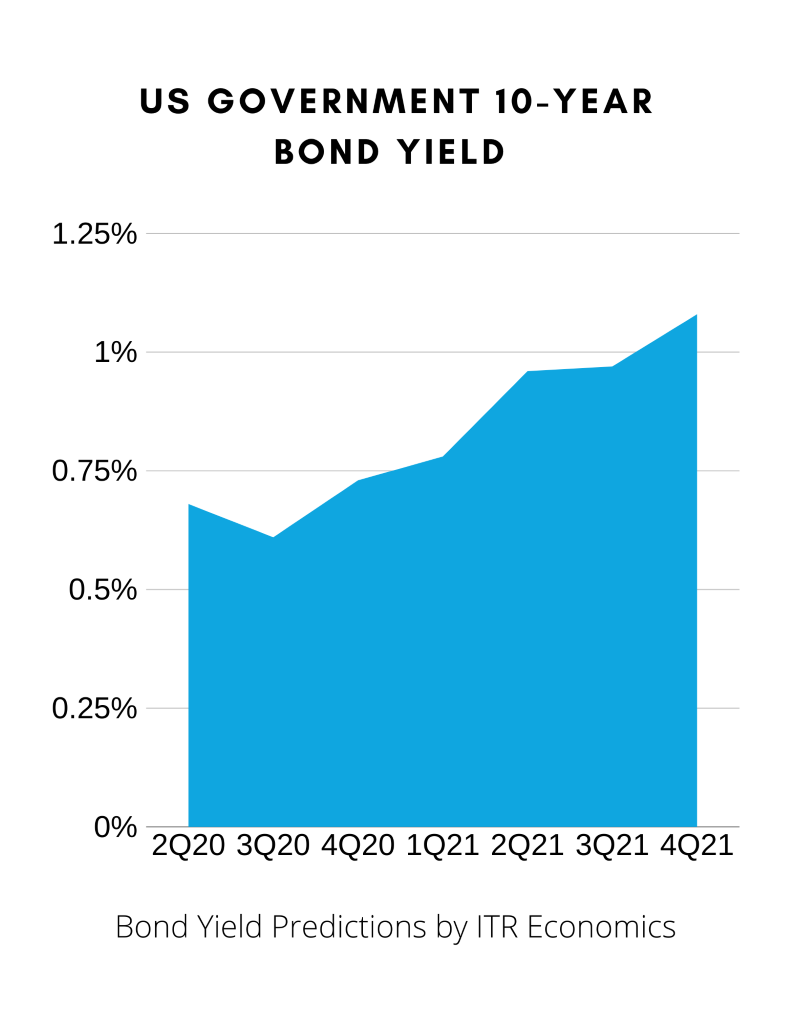

Interest rates reflect the price for renting a commodity called money. The Fed’s intervention into the credit markets and the global monetary policy stimulation means money is cheap. This month, ITR Economics predicted that interest rates will stay low through 2021.

Here is a quick look at their bond yield predictions by quarter:

Although the immediate damage to the fiscal wellbeing of the country seems to be offset by these low-interest rates, it’s important to remember what the interest rates will bounce back to in the future. Consider this if you plan to borrow at a fixed rate for an acquisition, market penetration, or investing in future efficiencies.

DEBT DISCUSSIONS BY STATE

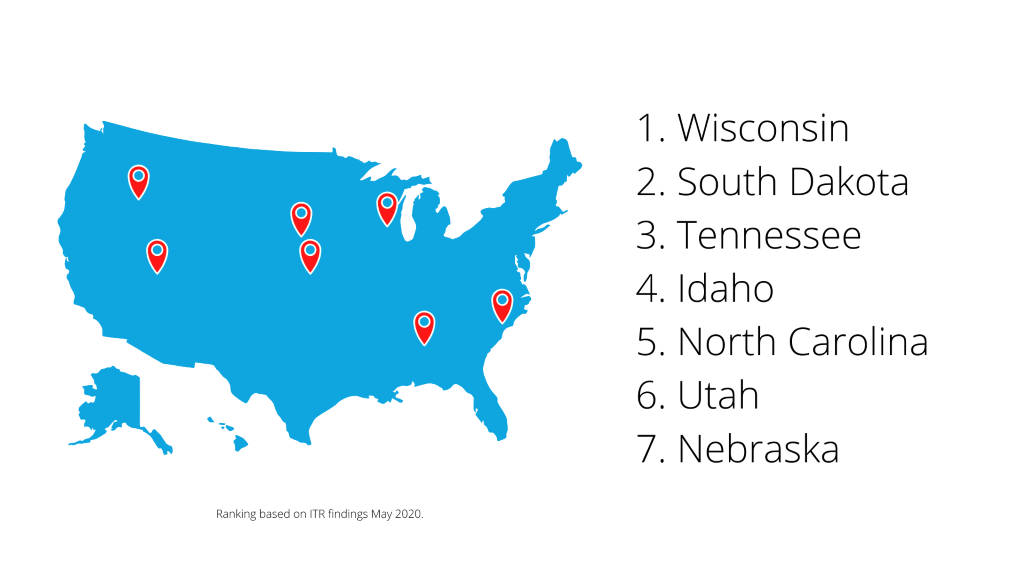

As the United States responds to the pandemic and increases its debt in the recovery efforts, ITR looked at state and local data to assess “best states” from a debt exposure perspective. These states qualified based on their debt as a percentage of the state’s GDP and how their pension funds are covered. Here’s a look at the top 7 states where ITR predicted financial stability in 2030 –2040.

ITR’s financial safe havens had the following debt and pension coverage:

- Wisconsin: 13.9% debt load and 103% pension coverage

- South Dakota: 12.9% debt load and 100% pension coverage

- Tennessee: 11.8% debt load and 97% pension coverage

- Idaho: 8.0% debt load and 91% pension coverage

- North Carolina: 8.5% debt load and 91% coverage

- Utah: 12.7% debt load and 90% coverage

- Nebraska: 13.2% debt load and 90% coverage

INDUSTRY WATCH

As the pandemic forced companies, schools, and organizations alike to adapt to remote services, there was a slight uptick in new orders for computers and electronics. Unfortunately, this trend does not offset the 15.6% decline in sales that US retail in the computer and electronics industry experienced in the last year (March 2019 – March 2020). ITR predicts spending to rise through much of 2022 before plateauing through the end of that year.

For more opportunities to discuss economic trends and challenges in the Silicon Forest please connect with our team in Portland, Oregon. Our virtual events for technology leaders in the area allows our network of professionals to gain industry insights and brainstorm solutions.